| Home |

Why our F@ST™BDS is Artificial Intelligence (AI) in Banking, cause It allows banks to make any systems such as : Web Teller System, Mobile Banking, Internet Banking, API to RTGS, API to Central Bank, APIs to E-Commerce, APIs to Card Center, Open Banking APIs and able to create and launch new products instantly. Until today all AI Tools in the cloud can only generate a website, convert text to image, edit image and video, advance search engine with user prompt and display in more detail, but can not allows users to make any systems.

F@ST™BDS for banking industries using new technologies: Web Browser Object, HTML, JavaScript, CSS, NodeJS, Bootstrap, MongoDB, Linux Server, and Microservice Architectures. The technology design leverages microservices, containerization, orchestration, asynchronous and serialization process. Microservices are an architectural and organizational approach to software development designed to speed up deployment cycles, foster innovation and ownership, and improve maintainability and scalability of software applications. This approach includes scaling organizations that deliver software and services. Using a microservices approach, software is composed of small independent services that communicate over well-defined APIs.

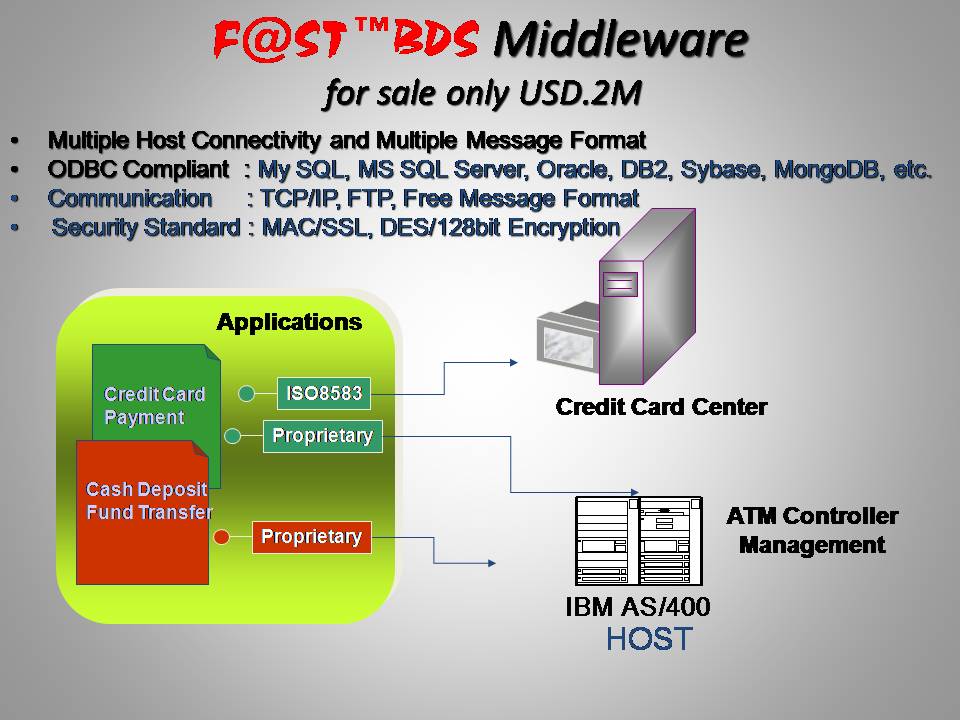

From demo presentation, development, deployment, implementation and go live all can be done remotely. F@ST™BDS is more powerful and smarter than you think. It is designed to meet all branch automation system (including digital banking) to the banking industries. It has unique product definition capability and rich parameters, which ensure that the banks are able to create and launch new products instantly. This gives them a significant competitive edge over its competitors, which is a vital need in today’s business environment. Easy to connect to any Existing Host cause F@ST™BDS is using tables to construct the message format such as ABCS Format, ISO8583 or Proprietary.

Now, more than ever, banks need to quickly and economically develop, implement and easily connect all branches to host core banking system. They must also be able to efficiently communicate with all these branches, which may be located in remote locations of vast countries like Indonesia, China, India and United States etc., even if the telecommunication line is in poor condition. Saving time in application development by employing new technology is of the essence for the banks to stay competitive and grow. To save time and cost for the customers in software development, deployment, modification, addition and distribution for branch system, we have spent more than three years in research and development to develop Next-Gen Web Teller Application - Branch Delivery System (BDS) called “F@ST™BDS” − a major breakthrough in BDS application software. Our specialists who developed this system have more than 25 years of combined banking application development and implementation experiences.

| Microservices |

The technology design leverages microservices, containerization, orchestration, asynchronous and serialization process. Microservices are an architectural and organizational approach to software development designed to speed up deployment cycles, foster innovation and ownership, and improve maintainability and scalability of software applications. This approach includes scaling organizations that deliver software and services. Using a microservices approach, software is composed of small independent services that communicate over well-defined APIs.

| API Management to manage all your microservices |

Microservices Architecture (MSA) implementation, where microservices discovery, authentication and management can be delegated to the central API management layer. There is a message broker for asynchronous inter-service communication.

| API management for modern hybrid system |

This design pattern is mostly suited for enterprises which have COTS systems as well as MSA. This pattern is easy to implement and has been identified as the common pattern to apply on hybrid microservices system.

| Total Digital Banking Solution |

We realizes that having a right technology and strategy are not enough. Choosing a complete branch automation systems solution requires support from experienced and knowledgeable business partner who understand the project life cycle. We can assist your institution in designing and implementing new financial products and services. Our scalable solutions meet the full range of branch automation systems and digital banking. The real challenge of automation project begins at the implementation and its success depends on how powerful of your applications.

Just take a look of what F@ST™BDS can help your organization in achieving these objectives and cost-savings:

F@ST™BDS is a wise long-term investment for Banks of all sizes. It addresses the three areas of particular concern to Banks seeking a cost-effective, networked computing environment: 1. Increased reliability and scalability; 2. Reduced Costs through improved end-to-end management capabilities; 3. Comprehensive web applications and Internet support

F@ST™BDS breaks away from traditional old-fashioned programming standard with microservices, containerization and orchestration − The “F@ST™BDS Engines”The engine behind F@ST™BDS is utilizing the latest technology adoptions by using microservices, containerization and service orchestration, which provides a solid platform for developing full-featured Branch Delivery System. Development Tools provide sets of Transactions builders, Shortcut Menu, Host Data Template, Input Validator, Journal Formatting, Message Format, Printer Format, Total Format, Import Data Utilities, and many more. It also consists of all the necessary fields required for parameters setting to create all types of branch transactions. All of the above are set in the familiar web menu system enabling any IT personnel to configure and setup transaction types easily.

The application package is constructed using business object mapping concept and using other advanced operating environments that allow multiple applications to be integrated into one seamless system.

Key Consideration - Unique FeaturesF@ST™BDS provides a wide range of sophisticated and integrated web branch solutions to the banking and financial institutions using new technologies. The state-of-the-art tools for building an application is very fast, the process of creating page, transaction, service is done within minutes. It also equipped with deployment system for instant update of changes.

The technology frameworks is based on V8 Runtime that powers NodeJS and Javascript we are using. It also uses ExpressJS as a primary middleware routers and incorporates other popular JS frameworks (NPM), Bootstrap, jQuery.

The software is a Single-Page Application (SPA), a web application or website that interacts with the user by dynamically rewriting the current web page with new data from the web server, instead of the default method of a web browser loading entire new pages.The goal is faster transitions that make the website feel more like a native application.

F@ST™BDS has unique product definition capability and rich of parameters, which ensure that the banks or financial institutions are able to create and launch new products instantly. This gives them a significant competitive edge over its competitors, which is a vital need in today’s business environment.

| Services |

We provide a complete range of software services, which include: consultancy services to help customers to identify process and required systems; lead management and project management; customization, conversion, integration, implementation and go-live support; full technical and user training; local, regional and global after sales support.

We are also well verse in the complementary products that are available such as ATM, PIN verification system, signature verification system, call center, credit card transaction system, etc.

As a full-service automation vendor, we guarantee full support for all aspects of system installation. The company has a solid and dependable implementation methodology, which enables it to efficiently manage, identify, assign, review, implement and test all network automation system. The benefit of this start-to-finish project implementation methodology is customer satisfactions and the system installation is delivered on time and on budget.

We welcome Global Partnership: In order to expand our business worldwide, we welcome interested business corporations for collaboration. Please send your enquiries to fastglobaltech@gmail.com| Product |

F@ST™BDS - (Branch Delivery System) is an advanced web teller applicatiojn and branch system. It automates all aspects of system development using state-of-the-art tools, which can cut down development and implementation time, and hence cost, by more than 80%. Transaction processing, cash control, signature verification, pin-pad transaction, cross currency and clients host online/offline transaction using TCP/IP protocol with high security protection are standard features. Processing control is tailored to your requirements and enforced automatically, ensuring that your institution’s procedures and guidelines are strictly adhered to. Lastly, and more importantly, we help the banks to cut costs.

F@ST™BDS application can seamlessly interfaced with your host installed by any third party as long as they have Online Transaction Processing. The system provides complete processing support regardless of whether the host is on-line or off-line, ensuring uninterrupted excellence customer service. Information can be posted to the host as processing occurs, or batched, according to your central processing requirements. Of course, tellers have immediate access to host data, allowing them to response to customer requests promptly for better customer’s satisfactions.

F@ST™BDS application provides the ideal solution to banks of medium and large sizes, with branches spreading across geographically dispersed complex network. As a truly open and integrated system, it allows workstations to run both teller and platform applications. You can expand traditional teller duties to include sales functions, or give access to selected teller transactions from the platform. Virtually any aspect of the system can be easily customized with our state-of-the-art tools within very short period of time to your specifications so you can shape your retail branches to meet your market and operational goals. We address almost all of the current shortfalls of existing BDS systems in the market.

Meeting Customer NeedsWe have designed F@ST™BDS using Microservice Architecture for today's and the Future of Banking Technologies. In every endeavor, the objective is the same, complete customer satisfaction by meeting all customer requirements. The company’s customer base includes medium and largest banks and financial institution. Our scalable systems meet the full range of banking requirements.

F@ST™BDS application can be easily customized to the unique needs of individual customers. It provides a comprehensive set of application customization and maintenance tools to allow authorized personnel to make changes for certain functions at the branch level. As part of a dedicated and experienced technology group, we offer our customers a large field of solutions that come from a global view of information technology. Our technology embraces platforms by the industry leaders such as Intel and Microsoft.

| Partnership |

One of the things that really set F@ST™BDS apart from most of the competition is the approach we take to our customers and their requirements for information technology. It is what we call our partnership approach.

No matter the bank and financial institution are looking for a specialized banking requirement, or a fully integrated branch delivery system, or a turn-key fully automated branch network, or for the redesign of workflow procedures, Our team’s approach will always be first to understand the context and the nature of the business problem. Having thoroughly understood the vital issue we then proceed to specify the functional requirements for the information technology solution, and then we are in a position to design the solution which solves the problem. The partnership approach will serve both F@ST™BDS and our banking customers well.

The main benefit for our banking clients derived from this approach are, that the customer deals with a partner who thoroughly understands the business context in which the IT system is working. This sets F@ST™BDS in a position to install and implement the solution and to support it throughout its’ lifecycle in a way that serves the bank’s business, not just its’ IT system. And it sets F@ST™BDS in a position to suggest new ways to solve the bank’s problems as technology evolves and enables us to provide even better IT solutions to business problems.

This is real protection of investment and it is evident that this approach works. It has earned F@ST™BDS the position as long term partner with our banking clients. Partnerships which have lasted through several generations of IT systems. Partnerships which go far beyond information technology.

| Investments |

F@ST™BDS Technology pays great attention to our clients’ needs. A major part of our investments is dedicated to the migration of the systems installed by our clients, with particular interests for banks in Indonesia. This base of banking clients and systems represent a major strength, and a major commitment to the future. This is a strength and a commitment from which also all new banking clients will benefit, because the expertise and experience accumulated through projects for all these banks are embedded in our banking offerings, and in the people who makes the systems work.

Due to our philosophy for efficient software design and ours believe that highly skilled engineers are expensive for our clients, our software requires the minimum highly skilled and paid engineers for application development and implementation. Our cost saving is as high as 60% as compared with other vendors, but without compromising our standard to fulfill the clients’ requirements - in fact we are even surpassing it. With this kind of cost-saving, we can survive any kind of market ups and downs to ensure that our clients are being served and we are the last one to leave the industry.

Your organization has the most efficient support provided by one of the most dedicated software application solution provider whose primary focus is to provide you with leading-edge application automation solutions!

We have a team of experts who have been serving the financial institutions for more than two decades and have gained in-depth knowledge about banking operation and web-based technology. Backed by our technical and industrial expertise, we are able to solve some of the most complex problems faced by the banking and financial industries in the past decades worldwide.

In order to achieve excellence customer services and stay competitive through effective use of the information technology, our company has consistently demonstrated the ability to deliver competitive products that reflect the latest technological developments and market trends, particularly in the areas of web-based standards and system architectures. We apply our technological expertise to delivering effective solutions that address users' real needs. Our comprehensive development programs ensure that our products and our customers stay ahead of the market.

…and this is only the beginning!

| Investments in R&D dedicated to further evolution of F@ST™BDS’s Banking Systems & Solutions: 2001 - 2025 |

Our Current Strengths

Our Current Strengths

|

Our commitment to the future

Our commitment to the future

|

| People&Skill |

The F@ST™BDS Banking Team encompasses banking consultants, systems engineers, marketing & sales, project managers, all dedicated to serving the banking market.

The consolidated experience and expertise of this team from analyzing banking business problems, designing technology solutions, customizing systems, planning and implementing solutions in projects on co-operation with banks worldwide through a period of more than 25 years combine to maybe the most significant value that banking clients can acquire anywhere in the world;

In-depth understanding of banking business problems and strategies.

In-depth understanding of enabling technologies.

In-depth know-how of FastBDS’s comprehensive banking offer.

Extensive experience in project design and management.

The numbers speak for themselves. The quality is more difficult to measure in numbers. However, our ongoing quality assurance program monitoring our performance in relationships with our banking clients tells us year after year that the quality of our people is the single most appreciated item in the entire range of products and services to the banking market

Our Current Strengths represent

Our Current Strengths represent

|

The focused investments F@ST™BDS makes in R&D, migration planning, training etc. both in terms of dedicated resources and in terms of commitment of funds.

The consistent activities to further enhance F@ST™BDS ’s partnerships with each banking client as well as with the banking industry.

| News |

We would like to announce that we have been officially appointed last year 2020 by the largest bank in Indonesia to install Next-Gen F@ST™BDS - Web Teller Application. Our client is one of the most aggressive bank emphasizing on serving their customers better through employment of advance technology. We have been chosen based on our technologically superior system - in terms of:

If you’ve

been waiting for a branch application system that is fast, easy and low-cost

in development, implementation and deployment, can connect all your branches

with your back-end host computer efficiently and in-expensively, you don’t

have to wait any longer!. Let us introduce our technologically advanced software called F@ST™BDS. It is catered to medium and large banks like yours who

have big numbers of branches across the vast archipelago. F@ST™BDS is

one of the fastest development software that can satisfy your complex

banking needs – in terms of comprehensive functions, time and cost saving

and customers satisfactions!. It supports full set of branch transactions and much more – such as signature

verification system, multi-currencies transaction, online and off-line transaction, etc. It is

upgradeable and scalable and it is so easy to use that your bank does not

require to hiring expensive highly skilled IT personnel to look after the

system. In fact, we even let your bank programs your own banking products

and services using our software tools – you have full control of your

banking business! Our credentials as a vendor of information technology solutions to the banking industry and as a partner for client banks in Indonesia are centred around: Successes in the past, present strength and commitment to the future. The successes achieved during 25 years as a provider of information technology solutions to banks in Indonesia have been due to basically 4 things:

An open mind, innovative ideas, good general purpose technology and co-operation with leading visionary banks. PT. InetUtama Systemindo Jl. Tanah Abang 1 No. 11F Fax: +62 (21) 352-3982, Phone: (021) 350-5994 Tanah Abang - Jakarta Pusat 10160 Indonesia

Next-Gen Branch Delivery System - Web Teller Application

F@ST™BDS’s Credentials

We welcome Global Partnership: In

order to expand our business worldwide, we welcome interested

business corporations for collaboration. Please send your enquiries

to fastglobaltech@gmail.com.

Corporate Information

Contact

E-mail: tjekh10@gmail.com or fastglobaltech@gmail .com

| All Rights Reserved, Copyright © PT. InetUtama Systemindo 2025 |